Conventional mortgages are the most popular form of home financing for buyers in the United States. However, it may not always be clear how these loans differ from other loans, such as those provided by government agencies. To help you gain a better understanding of conventional loan basics, here is a quick guide with further information:

When obtaining conventional financing, your lender will examine your financial situation. The loan officer may request information including your credit score, income statements and debt to income ratios.

A down payment is required for conventional loans. Each lender has different minimum requirements, but the larger the down payment, the less money you’ll have to pay back over time.

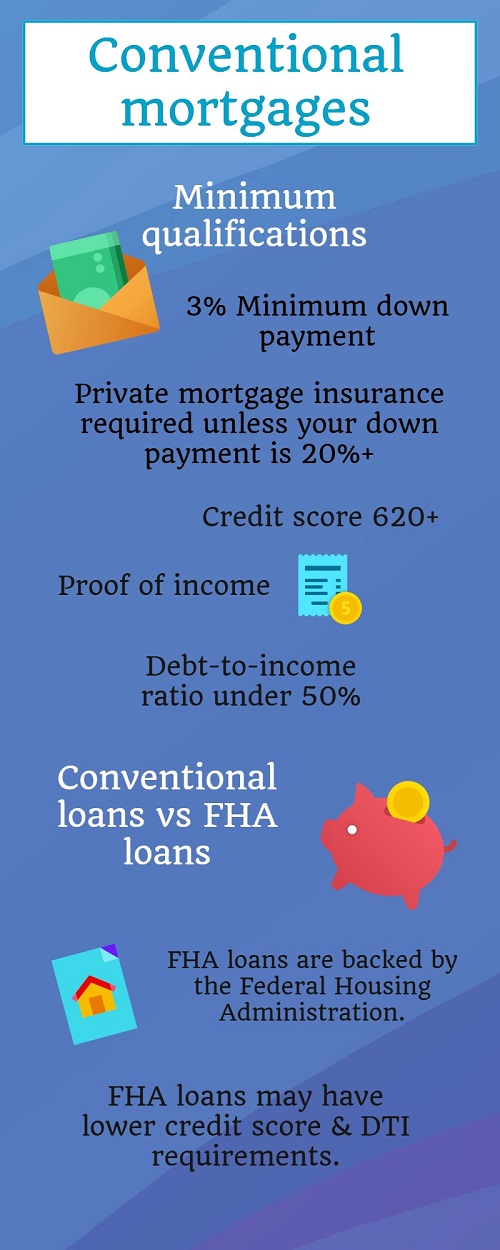

Many believe a 20% down payment is required for conventional loans, but the minimum requirement is typically much lower. You can find mortgages with minimum down payment requirements anywhere from 3% to 20% of the overall purchase price.

Your choice of down payment amount can affect the terms of your mortgage, like interest rate or the need for private mortgage insurance.

Government-backed home loans have specific features to suit some homebuyers.

The Federal Housing Administration (FHA) is a government institution offering home loans for buyers who meet certain qualifications. Government-backed loans have advantages for those with bad credit or other financial roadblocks, but require other qualifications for approval.

Conventional mortgages tend to have higher interest rates than FHA loans, although these loans typically require borrowers to pay mortgage-insurance premiums.

Interest rates charged on a conventional mortgage vary by several factors, including the term and amount borrowed. However, interest rates are also subject to change every year based on the overall economy. Many buyers choose to wait for a period when interest rates are lower to apply for a mortgage, regardless of the loan type.

Ultimately, your choice of loan will depend on your personal circumstances. The more you know about different types of mortgage, the better equipped you’ll be for your journey into thefinancial real estate marketplace.

欢迎来到 Garden State Realty LLC,一家值得信赖的精品房地产经纪公司,位于新泽西州利文斯顿,致力于为来自世界各地的客户提供优质服务。凭借对房地产行业的热情和卓越的成功记录,我们赢得了卓越、专业以及独特个性化服务的良好声誉,使我们在行业中脱颖而出。

我们服务的核心在于优秀房地产专业人士的关键特质:坚定不移的诚信、深入的市场专业知识、创新的营销策略、娴熟的谈判技巧以及广泛的高质量专业网络。这些品质是我们业务的基础,确保每位客户都能获得卓越的成果。

我们致力于提供顶级服务,通过将您的需求置于首位,积极倾听、清晰沟通,并迅速响应您的每个需求。不论您是买房、卖房还是投资,您都可以信赖我们作为可靠的合作伙伴,全程陪伴您左右。欢迎加入我们的客户群体,在这里,您的目标就是我们的使命。